$MOB.ST on June 29, 2024

Stock Price: 29.06 SEK

Market Cap: $134M

SUMMARY

Poor efficacy, risk of liver damage, and numerous contraindications in legacy nail fungus treatments have left hundreds of millions of potential patients untreated and in need of a better alternative.

MOB-015 kills onychomycosis at least as well as the most effective current treatment option without the side effects and contraindications that prevent oral terbinafine from being prescribed at high rates. The “best-of-both-worlds” treatment is primed to take over the existing market and expand treatment rates.

The first North American phase 3 trial produced a poor complete cure rate due to an overhydration of the nail. Even though the infection was cured at a high rate, the nail’s appearance remained altered, so it failed the complete cure criteria. The company believes a modified dosing regimen in the second phase 3 will avoid overhydration, yield a much higher complete cure rate, and offer a treatment schedule that is less burdensome for the patient.

With Europe selling independently of the phase 3 result and milestone payments boosting returns on early sales, the risk of permanent capital loss is lower than it appears, and there is potential for extreme upside via the U.S. prescription market (which will be explored in Part 2).

PREFACE

This piece is intended to lay out the opportunity as clearly as possible. Much has been left out in the interest of being concise. I hope this will serve as an introduction for those new to the name and be a refresher for those already familiar.

To get the most out of your reading, please review some of the resources linked in the text. Bolded text should be noted as key points. Let’s dive in.

INTRODUCTION

Moberg Pharma is a Swedish pharmaceutical company that has developed a topical nail fungus (onychomycosis) treatment known as MOB-015. This is their only product. Aside from the podiatry segment in the U.S., all markets are (or will be) licensed out. The business should remain lean with minimal expenses and reduced market risk because of this model.

MOB-015 was launched in Sweden in February 2024 as an OTC product under the brand name Terclara (product leaflet) at an MSRP of 399 SEK ($37.60) per unit. The pan-European launch with Bayer ($BAYN.DE) is slated for early 2026. Cipher Pharmaceuticals ($CPH.TO) expects to launch the product in Canada in the second half of 2026. The U.S. launch will come in early 2027, following the phase 3 readout in January 2025 and FDA approval in late 2026.

The formulation contains the potent antifungal terbinafine, delivered to the nail by a proprietary vehicle. The vehicle is the innovation; it is why MOB-015 is poised to become the standard of care for onychomycosis globally. Normally, terbinafine (and other antifungals) cannot penetrate the nail deeply enough to reach the nail bed, so legacy topicals have poor cure rates. For this reason, doctors tend not to prescribe topicals or do so with the expectation of failure.

Oral terbinafine (Lamisil) is the most effective treatment available. However, it carries the risk of liver failure and has drug interactions which preclude many patients from treating the condition orally. Contraindicated drugs include antidepressants (19% of U.S. seniors) and beta-blockers (22.3% of U.S. seniors). As a topical, MOB-015 carries no such risks.

MOB-015 has the safety profile of a topical with the efficacy of the leading oral treatment.

The formulation currently has patent protection in major markets through 2031, with the possibility to extend protection through 2045 with a new patent, partially contingent on the phase 3 result due in January.

Read the linked patent document.

Link: My reformatted version of the patent document with key points highlighted

TREATMENT RATES

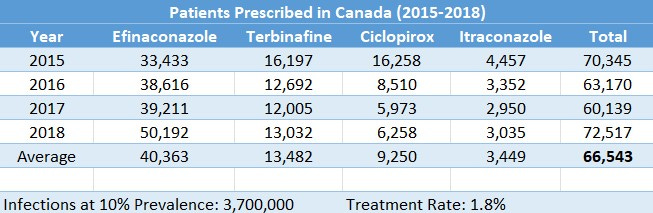

A 2021 Bausch report used retail pharmacy data to explore product-switching behavior in onychomycosis patients. The dataset is not comprehensive, so this is almost certainly an underestimate, but these totals can be used to give us a starting point in Canada:

In 2021, an estimated 569,640 patients were prescribed ciclopirox in the U.S. In the same year, an estimated 800,034 patients were prescribed oral terbinafine: 1,369,674 patients between the two. Not everyone who takes terbinafine does so for onychomycosis, but we will ignore this to hedge the risk of an underestimate. Efinaconazole and tavaborole would have added little to the total in the U.S. so we can round up to 1.4 million Americans treated in 2021. Assuming a prevalence of 10%, that is a treatment rate of 4.2%. Assuming a prevalence of 13.8%, the treatment rate falls to 3.1%.

I feel comfortable ballparking treatment rates at 3-5% in major markets. 95%+ of onychomycosis patients (globally) are left untreated. Of course, most of that TAM is likely unobtainable due to lack of awareness or care, but if even 5% of the TAM is treated at a given time, that represents roughly 40 million patients for a product bringing in anywhere from $10 to $2000+ per unit depending on the market.

WHY DOES THE OPPORTUNITY EXIST?

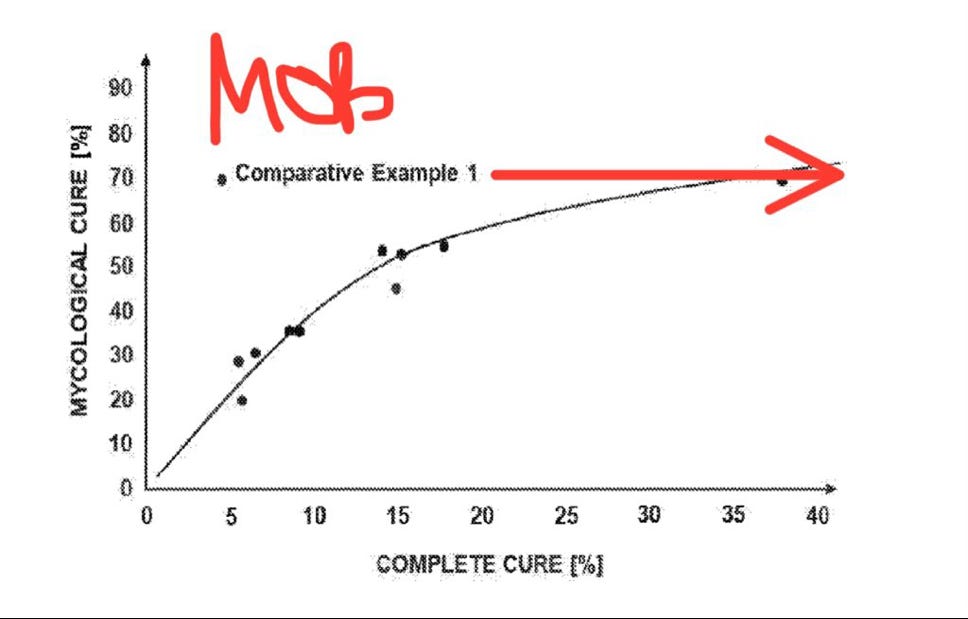

In the first N.A. phase 3 study, MOB-015 produced a complete cure rate of 4.5%. That is very poor compared to legacy topicals which range from 7% to 16.5%. There are countless examples of investors and medical professionals offering dismissive opinions on the company with the low complete cure rate at the core of their rationale. “It doesn’t work.”

However, a closer look reveals that the low complete cure rate is not a failure to kill the fungus, but rather due to an excessive dosing regimen that overhydrates the nail and creates a “whitening” effect. That discoloration is enough to fail the visual inspection required to pass complete cure.

The other endpoint of interest is mycological cure. Mycological cure has been achieved when the fungus will not grow in culture AND when fungal structures cannot be detected under the microscope. Mycological cure evaluates fungal infection, and complete cure is mycological cure + full nail restoration.

MOB-015 has repeatedly demonstrated mycological cure rates competitive with oral terbinafine at 70% in the first N.A. phase 3 and 84% in the European phase 3 trial. Oral terbinafine mycological cure has been shown to range from 71% to 82%. Complete cure tends to track mycological cure, but that has not been true with MOB-015 yet (see patent doc).

Surprised by the discrepancy in cure rates in the first N.A. phase 3, the company consulted key opinion leaders to understand why.

Key conclusions include: i) MOB-015 delivers a very high mycological cure rate that compares favorably to oral antifungal drugs with the added advantage of an earlier onset of action; ii) Confirmation that the proprietary vehicle technology increases the hydration and permeability of the nail plate enabling efficient terbinafine delivery, however it also confounds the assessment of clinical cure and complete cure and iii) A likely solution to the problem - a shorter dosing regimen with the potential to deliver superior complete cure rates.

In the ongoing phase 3 trial, patients will undergo 8 weeks of daily application (loading phase), followed by 40 weeks of weekly application (maintenance phase). If successful, this regimen will replace the current 48-week once-daily regimen.

Aside from the opinions of company execs, trial investigators, and key opinion leaders, what information do we have to suggest the new dosing regimen is likely to be successful?

Whitening in previous trials tended to occur after 8 weeks.

Complete cure improved significantly in the first N.A. phase 3 between when treatment stopped (week 48) and when final evaluations were performed (week 52).

Early anecdotal reports and photos from Terclara users show promising results.

has been on top of this: some of his patient contacts have chosen to test the new P3 regimen to gain insight.

PRIMARY RISKS

The ongoing phase 3 is the obvious risk. If that goes poorly, the crazy upside is gone. The product will still exist and will still sell, but it would not be what it COULD be with a complete cure rate of 40%+ and the new dosing regimen. The expected value of the trade going forward would be dramatically reduced.

M&A, R&D, capital allocation. Pharma’s greatest weakness. The company has expressed an interest in building a “commercial platform in the U.S. to target podiatrists with MOB-015 as the main product, and which will be complemented going forward by additional niche products.” They will use a significant portion of their cash to acquire and build out this team in preparation for the U.S. launch. I am less concerned about this particular event than capital allocation going forward. MOB-015 is such a special asset with tremendous upside. All efforts should be focused on maximizing its potential rather than wasting capital chasing the dream of a pharmaceutical empire, or spending money just because you have it. Shareholders will always welcome capital returns in a situation like this.

Generic Jublia. The next most effective topical is Jublia (efinaconazole) at 54% mycological cure and 16.5% complete cure. Under patent and not well-covered by insurance in the U.S., Jublia is prohibitively expensive at $5k-$6k to treat one large toenail. Under those conditions, it is not a serious competitor, but generic versions would be far more affordable. Anna does not see efinaconazole generics coming to market soon (at 20:00). However, it will happen eventually, and generic efinaconazole will make a step therapy approach from insurance companies more likely in the U.S. (i.e., you must try and fail with efinaconazole before they cover a MOB-015 prescription). This risk is largely isolated to the U.S. market, as MOB-015 will be more competitively priced elsewhere.

VALUATION

The company announced in May that Terclara became the market leader in Sweden, overtaking Moberg’s previous generation product, Nalox (a.k.a., Kerasal Nail). Kerasal and the rest of Moberg’s lesser OTC assets were sold for $155 million in 2019 (3.3x sales). In 2021, the (notoriously) conservative CEO, Anna Ljung, said the potential of MOB-015 is something like 10 times that of Kerasal, along with some other interesting things:

“There is really no medical reason you shouldn’t choose MOB-015 when you treat onychomycosis, just given the data.” Early sales data suggests Swedish consumers agree.

The following attempts at framing the situation quantitatively are built upon the belief that MOB-015 is a superior product and will outsell the competition. If you disagree on that point, I would be interested in hearing your reasoning.

MILESTONE NAPKIN MATH

We will use enterprise value because every market ex-U.S. will be licensed out (thus, minimal operating expenses) and trial-related cash burn will conclude soon.

EV = $99M

If regulatory, commercialization, and sales criteria are met, current agreements will provide $66.6M more in milestones. The specific milestones to be met have not been disclosed. Cipher will pay $14.6M, and Bayer will pay 48.5M EUR ($52M).

NPV of milestones received a year after assumed launches (20.6% tax rate and 8% discount rate):

$9.2M (CA) + $32.8M (EU) = $42M

EV w/ NPV of EU + CA milestones = $57M

In 2019, Taisho Pharmaceutical Co. signed a $50M licensing deal with Moberg. In 2023, Taisho returned the rights to MOB-015 after a management buyout which led to a restructuring of their product pipeline. Moberg will find a new partner in Japan following the ongoing phase 3. A good trial result and strong sales in Sweden will offer more negotiating leverage. So, it is likely the next Japanese deal will exceed $50M. Let us assume $60M received in 2028:

EV w/ NPV of EU + CA + JP milestones = $22M

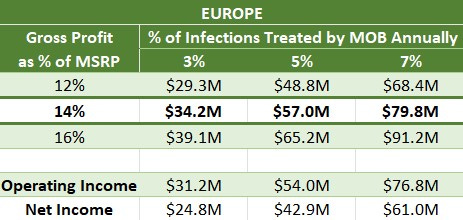

A MODEL OF EUROPE

The binary risk of drug trials can be a dealbreaker for investors. While I believe this trial is exceptional in its simplicity and likelihood of success, a lot does hinge on the result. So, let us set North America aside (where you get all the torque) and see what the company may earn from the 13 approved EU countries under the current daily label. Is it worth buying for European sales alone?

Model Assumptions:

10% prevalence (probably low, large-scale studies suggest 14% in Italy and 13.8% in the U.S. with prevalence trending higher).

The 6 countries with Rx approval will switch to OTC approval as real-world data on the product becomes available.

No inclusion of the U.K., Germany, or other European markets to be pursued later.

An average of 4 infected nails per patient (the mean number of infected nails was found to be 4.4 in a Polish study).

An average of 0.03 ml of product per nail per day from a 5 ml tube.

270 million total inhabitants across the 13 approved countries.

48-week treatment course with once-daily applications (8 units per treatment course on average).

$3M in annual opex based on Q1 2024 opex, annualized and rounded up.

Corporate tax rate of 20.6%.

If we rely only on these 13 countries (in the lowest-margin, lowest-cost market), Moberg could earn $24.8M to $61.0M annually, plus $52M in milestone payments. Assume the payment comes in 2027, a year after the EU launch, taxed at 20.6%, and the NPV of that with an 8% discount rate is $32.8M.

EU-adjusted EV = $99M - $32.8M = $66.2M

Investors are paying $66.2M for a global enterprise whose least lucrative major market could earn $24.8M to $61.0M annually. The low end of this range likely happens within a few years from launch, judging from the early success seen in Sweden, which will become clearer when Q2 earnings are released.

Europe is the safety net, the high probability bet for a modest return.

The fun part is what comes next (Part 2), where I get to tell you how a small Swedish pharma company has the opportunity to generate tens of billions of dollars curing American nail fungus.

This is a bit more complex than OTC Europe given uncertainties around insurance coverage, so I have chosen to lay the foundation here and dedicate the next piece to the turbo bulls, of which I am one.

If you feel your time was well-spent reading my work, please share this widely. That is what I ask in exchange for providing free access to this labor of love.

Thanks for reading,

Sharpe

I hold a material investment in Moberg Pharma. My positioning may change at any time and without notice.

I do not work for the company in any capacity.

I write for informational purposes only; nothing written should be misconstrued as financial advice.

I appreciate your work! I'm really looking forward to part 2. As another mentioned, curious of your thoughts on MEDXF's competition risk and whether MOB's formulation of terbinafine is superior (MEDXF plan to commercialize topical terbinafine hydrochloride nail lacquer supplied by Polichem, estimates the total value of the Canadian fungicides market to be C$88 million annually)

Given the success in Sweden, why do you think the European OTC launch will take until 2026? Any insight if that can be accelerated?